Coldwell Banker Commercial (CBC) professionals specializing in office properties create tailored real estate solutions for both landlords and tenants. With a deep understanding of today’s business landscape, they help identify office spaces that align with specific business objectives, from unique business needs to value-add investment opportunities. Whether leasing office space, buying or selling an office building, CBC professionals develop customized solutions to fulfill your real estate goals. With nationwide market access and tools to support informed investment and relocation decisions, CBC experts provide innovative solutions to meet your requirements. As trusted advisors, they are client-focused and results-driven, offering insightful ideas and strategies for success.

Land transactions require a deep understanding of planning, zoning, development, engineering, water rights and investment analysis. CBC professionals specializing in land transactions bring extensive experience and can streamline the due diligence process, helping you save time and money to make informed, strategic decisions. By assisting with feasibility studies, site selection, pro forma analysis, acquisitions and dispositions, they enable you to maximize the value of your real estate portfolio and boost your return on investment. You can rely on a CBC professional as a trusted advisor, offering innovative and profitable solutions.

Coldwell Banker Commercial (CBC) professionals specializing in retail properties are experts in all aspects of retail brokerage. Drawing on years of commercial real estate experience, they develop strategies to enhance your bottom line whether you are an owner, buyer, or tenant. Retail specialists work with owners to maximize asset value before a sale through detailed financial analysis, market repositioning and new tenant acquisition. For buyers, they provide insights to support informed decisions aligned with investment strategies and long-term goals. With deep expertise in site selection and negotiation, CBC associates help tenants secure the ideal location and achieve favorable purchase prices or lease terms.

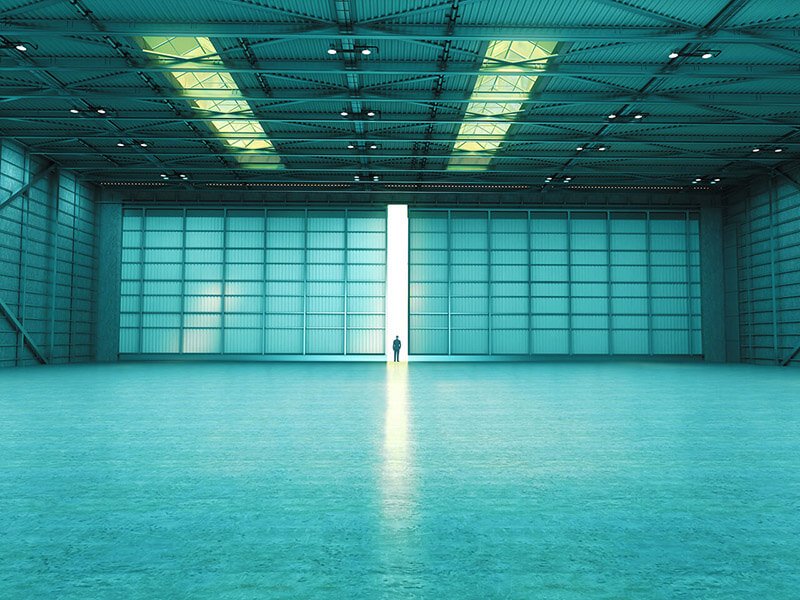

Coldwell Banker Commercial (CBC) affiliated professionals bring expertise in all aspects of industrial real estate, offering comprehensive services to help achieve your business objectives. The demand for industrial real estate investment has been fueled by advancements in robotics, which have automated manufacturing processes and significantly reduced labor costs. Additionally, the shift toward eCommerce has transformed the economy, creating a substantial need for warehousing and logistics space. Whether you are a corporate client with evolving space requirements, a local private owner, or an institutional investor with a multi-market presence, CBC professionals are ready to serve as your trusted real estate advisors.

Commercial agricultural properties are used to generate revenue through the production of crops for human consumption, such as fruits, vegetables and meat, or raising livestock for sale. Agricultural land can include farmland, ranches, orchards, vineyards and other types of agricultural operations. Some agricultural properties may include existing infrastructure like barns, silos, irrigation systems, poultry houses and greenhouses, which can increase the value of a property. As with other types of commercial real estate, a property’s value and potential for revenue are influenced by several factors, including location, accessibility, market demand and the quality and maintenance of infrastructure.

Coldwell Banker Commercial® affiliated professionals with agricultural expertise are well-versed in the unique opportunities and challenges that shape successful agricultural land transactions.

With access to local market data and industry trends, CBC professionals equip you with the insights needed to make informed decisions that align with your investment criteria. As a seller, your trusted advisor can offer innovative strategies to enhance market appeal and drive higher sales prices. For buyers, CBC professionals analyze current market conditions and future trends, providing support with cash flow analysis, lease review and other due diligence tasks to facilitate a well-informed acquisition decision

Commercial properties are considered distressed primarily when the owner experiences financial trouble and is unable to pay the mortgage or other debts. However, the “distressed” label also applies to properties that have deteriorating conditions either from poor management or environmental causes. As a result, distressed properties often have below-market occupancy rates, high vacancy rates or have become obsolete, either physically or functionally. In such cases, buyers who are willing to undertake rehabilitating or repositioning the property may find a unique investment opportunity.